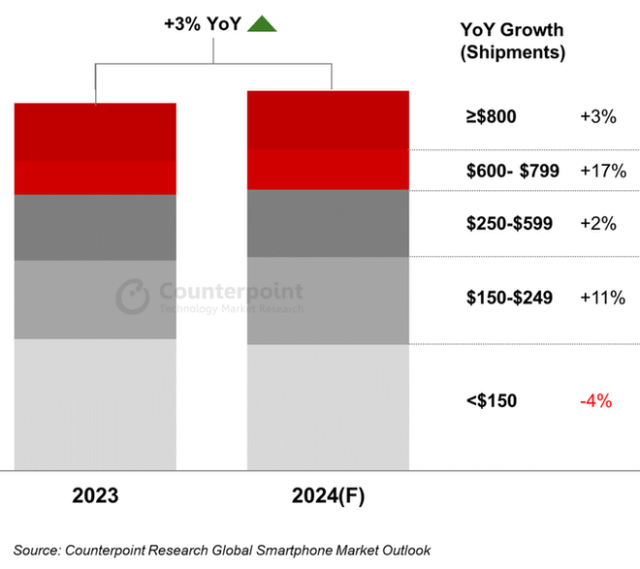

Global smartphone shipments in 2024 are expected to record a modest rebound of 3% YoY to reach 1.2 billion units, according to Counterpoint Research’s Global Smartphone Shipment Forecast. The budget-economy segment ($150-$249), which shrank YoY in 2023 due to macroeconomic headwinds, especially in emerging markets, and the premium segment ($600-$799) are expected to drive this rebound.

Unlike 2023, emerging markets such as India and the Middle East and Africa (MEA) are expected to drive the global smartphone market’s growth in 2024, supported by the budget-economy segment. The robust inventory levels in Q4 2023 are also expected to help.

Global Smartphone Market Shipments by Price Band, 2023 vs. 2024

The budget-economy segment ($150-$249), which experienced a noticeable decline in 2023, is expected to rebound 11% YoY in 2024, primarily driven by India, MEA and CALA (Caribbean And Latin American) markets. As inflationary pressures have eased considerably across Africa, and local currencies have stabilized in many countries, the consumer purchasing power has recovered, benefiting the $150-$249 segment.

Steady investments into the MEA and CALA markets by Chinese OEMs like OPPO, vivo, Xiaomi and Transsion Group have intensified the competition, stimulating the demand for budget-economy smartphones. Alongside the recovery of demand for IT devices in emerging markets, the intensified competition between Chinese OEMs will be the main growth driver in the segment.

The premium segment ($600-$799) is expected to maintain steady growth in 2024, rising 17% YoY. In particular, the introduction of GenAI smartphones and the popularity of foldables will stimulate consistent demand for premium smartphones.

Apple and Huawei are likely to lead the premium segment’s growth. The steady demand for iPhones, particularly in emerging markets such as India and MEA, will drive Apple’s growth. Huawei is expected to retain its strong presence in China’s smartphone market in 2024. With the release of its 5G Kirin chipset, the brand will continue to see a sturdy demand in China.

MacDailyNews Take: For the longer term, Counterpoint Research expects “low-single-digit YoY increases for global smartphone shipments as the market seems to have bottomed out.”

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.